Beverage News

More Than $400 Billion at Stake in the Beverage Industry

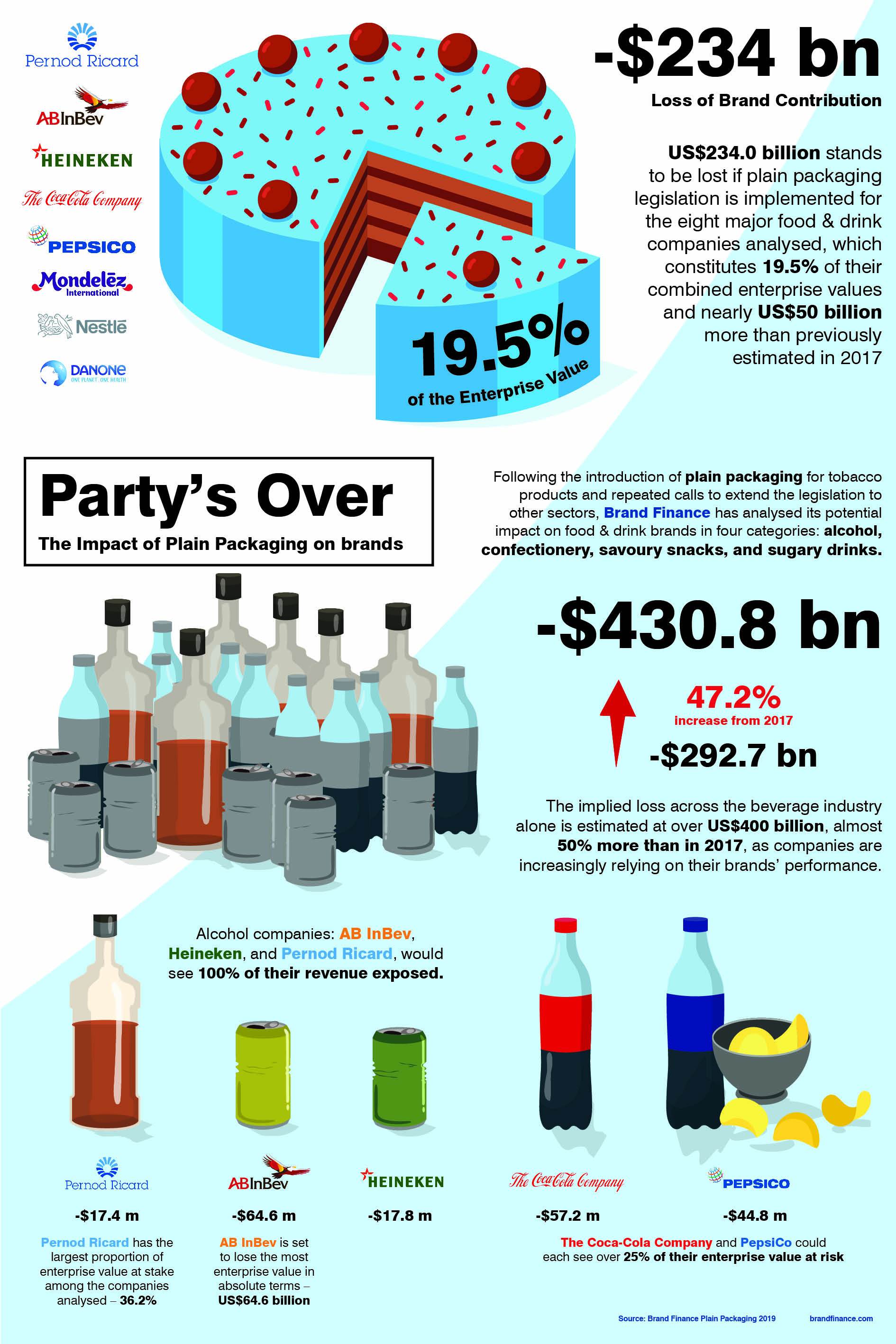

Brand Finance has estimated the potential value loss to businesses at US$430.8 billion if plain packaging is extended to alcohol and sugary drinks worldwide.

Brand Finance has estimated the potential value loss to businesses at US$430.8 billion if plain packaging is extended to alcohol and sugary drinks worldwide.

This represents an almost 50% increase compared with Brand Finance’s 2017 valuation, as brand values grow and parent companies are increasingly relying on their brands’ performance.

Pernod Ricard, at 36.2%, has the largest proportion of enterprise value at stake.

Brewing giant, AB InBev, would lose the most enterprise value in absolute terms –US$64.6 billion.

Following the introduction of plain packaging for tobacco products and repeated calls to extend the legislation to other sectors, Brand Finance has once again analysed the potential impact of such a policy on food and beverage brands in four categories: alcohol, confectionery, savoury snacks, and sugary drinks. Responding to a growing demand for more up-to-date analysis, this second iteration of the Brand Finance Plain Packaging report builds on the findings of the original 2017 study and is being launched today at the Food Ethics Council’s Food Policy on Trial event in London.

Eight major brand-owning companies are predicted to lose a total of US$234.0 billion, with alcohol and sugary drinks brands the most vulnerable. Given the growth of brand values over the last two years, the estimation is nearly US$50 billion larger than the US$186.7 billion calculated in 2017, when the first study was conducted.

Alcoholic drinks producers like Heineken, AB InBev, and Pernod Ricard would see 100% of their revenues exposed to the legislation, jeopardising the current business model.

Pernod Ricard, at 36.2%, has the largest proportion of enterprise value at stake. Similar to other drinks giants, AB InBev and The Coca-Cola Company are both set to lose over a quarter of their enterprise value. They are also the two corporations in the study with most absolute value at risk: US$64.6 billion and US$57.2 billion respectively.

PepsiCo, owner of popular snack brands such as Lay’s, Doritos, and Cheetos, as well as its iconic eponymous soft drink brand, would see over two-thirds of its brands affected by the legislation, the highest proportion of any company outside of alcoholic beverages.

An extrapolation of the results to all major alcohol and sugary drinks brands, points towards a potential loss of US$430.8 billion for the beverage industry globally.

The estimates refer to the loss of value derived specifically from brands and do not account for further potential losses resulting from changes in price and volume of the products sold, or illicit trade. Therefore, the total damage to businesses affected is likely to be higher.

This should raise concerns not only for brand owners but also for governments, policymakers, marketers, and campaigners. David Haigh, CEO of Brand Finance, commented:

This should raise concerns not only for brand owners but also for governments, policymakers, marketers, and campaigners. David Haigh, CEO of Brand Finance, commented:

“Since we produced the first Brand Finance Plain Packaging report in 2017, a number of other countries have either implemented – or legislated for – plain packaging for tobacco products. With health advisors labelling obesity ‘the new smoking’, it is not surprising that there have been repeated calls for this type of legislation to be expanded into the food and drinks sectors. It is obvious, however, that this would severely damage these companies’ business values.”

David added: “However, the predicted loss of brand contribution to companies at risk is just the tip of the iceberg. Plain packaging would also lead to losses in the creative industries, including design and advertising services, which are heavily reliant on FMCG contracts.”

Background

Plain packaging is often referred to as a branding ban or brand censorship. By imposing strict rules and regulations, the legislator requires producers to remove all branded features from external packaging, except for the brand name written in a standardised font, with all surfaces in a standard colour.

An increasing number of countries are introducing strict regulations on the marketing and advertising of food and drink products in an attempt to prevent obesity and lifestyle diseases. With calls for more intrusive measures growing, the prospect of further applications of plain packaging looks increasingly likely.

In 2015, the WHO-backed Tobacco Atlas, called for extending plain packaging to alcohol and some food and drink products. In 2016, Public Health England released a report calling for plain packaging to be considered for alcohol. In October last year, Ireland passed a Bill to introduce mandatory, sizeable health warning labels on all alcohol products, cautioning against the risk of cancer. Earlier this year, UK think tank, the Institute for Public Policy Research, called for plain packaging to be extended to all confectionary, crisps and sugary drinks, to put them on ‘a level playing-field with fruit and vegetables’.

For full findings access the Brand Finance Plain Packaging 2019 report here.

Source: Brand Finance